Content

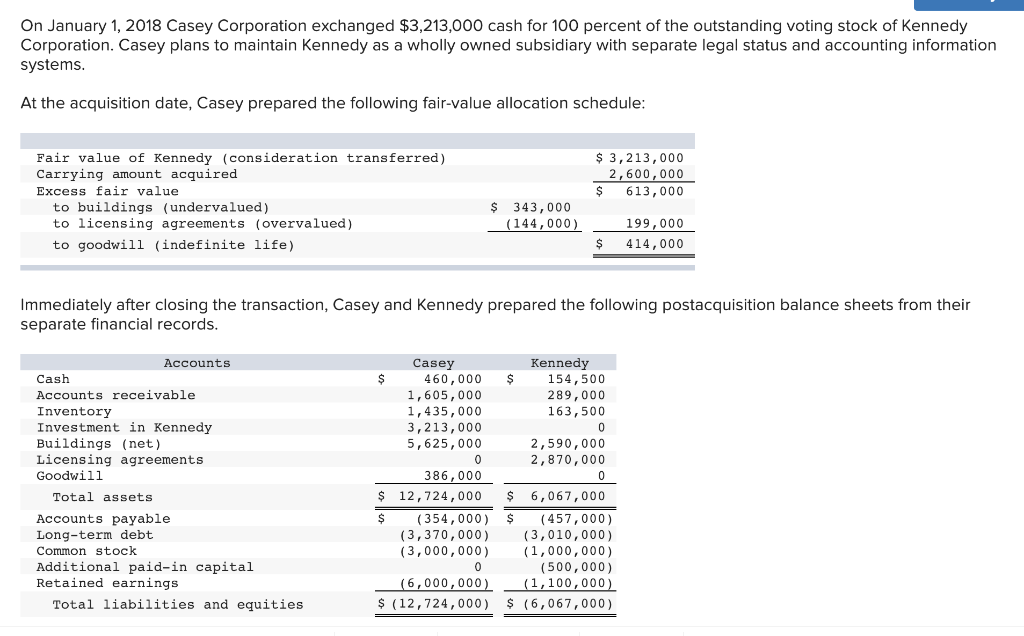

When acquisitions are made, the acquirers cash and debt levels will also be affected. Acquirers are also likely to pay over the asking price of the acquiree because of “goodwill,” which is an intangible asset. As you can see in the image above, total CapEx is equal to the sum of the fixed asset dollar amounts . In this example, the lemon crusher has an asset life of 2 years and the lemonade stand business must spend $3,000 every 2 years to buy a new lemon crusher. This is also known as property, plant and equipment (aka PP&E) and shows up under investing activities on the cash flow statement. Common asset line items include cash and equivalents, accounts receivable, inventory, and other fixed assets. Common liability line items include accounts payable, accrued liabilities, and debt.

Twenty years ago, fixed assets were the leading generators of revenues for companies. Think of the leading companies, such as IBM, Exxon, and GE, which were all heavy in fixed assets such as machinery, plants, and the raw materials that the companies turned into revenues. To calculate the yearly expense for the company’s purchase, the company first determines the likely useful life of that acquisition. And to calculate the yearly expense, we divide the purchase price by the useful life, which gives us a value of $2,143. There are additional methods of expensing business assets that are common in the oil industry, for example.

Get an EIN for Your Business

Annual amortization expense reduces net income on the income statement, which also reduces retained earnings in the stockholders’ https://online-accounting.net/ equity section of the balance sheet. Retained earnings consists of a company’s net income that it has kept in its business.

A depreciation schedule is required in financial modeling to forecast the value of a company’s fixed assets , depreciation expense , and capital expenditures . The vehicle is a tangible asset with a salvage value, but amortization applies to intangible assets such as licenses, grants, and patents. Depreciation is an accounting method that represents how much value of an asset has been used, which accounts for an expense on the income statement. The remaining useful lifespan of the asset counts as the asset of the company. The depreciation expenses are tax deductible, which helps the business gain tax benefits. Depreciation would also cease when an asset’s accumulated depreciation equals its cost minus salvage value, if any. NE’s software will serve the company well for years, but NE will have to expense it in year one per GAAP accounting.

What Is Amortization?

For this example, this ending cash balance represents the real cash balance at the end of the company’s fiscal year. This number then flows into the cash line item (typically shown as “cash and equivalents”), which is a current asset on the balance sheet. Given the liquidity of cash, it will always be a top-line item on the balance sheet. The main purpose of an income statement is to show whether or not a company has a profit or loss, as typically shown over three months or a full year. Most income statements use accrual accounting, which means that revenue and expenses are realized as they’re earned and billed . Depreciation and Amortization affect the equity and balance sheet of the company, respectively.

- In any case, an overview of the three financial statements is broken down in the three sections below.

- This method provides a greater tax credit for the company in the earlier years of depreciation.

- To counterpoint, Sherry’s accountants explain that the $7,500 machine expense must be allocated over the entire five-year period when the machine is expected to benefit the company.

- Amortization is an accounting technique used to periodically lower the book value of a loan or intangible asset over a set period of time.

Accumulated Depreciation is the entire portion of the cost of an asset allocated to depreciation expense since the time an asset is put into service. From there, gross profit is impacted by other operating expenses and income, depending on the nature of the business, to reachnet income at the bottom — “the bottom line” for the business. If it seems that the depreciation expense has remained constant, the company may be using a linear depreciation policy, such as the straight-line depreciation method. In such a case, it is handy to use depreciation expense as a percentage of net PP&E, or to simply roll forward the recurring depreciation amount. Under MUP depreciation, within a broad range of production levels (the “variable production range”), depreciation is directly proportional to usage .

What is a Depreciation Schedule?

Depreciation and amortization play key roles in business accounting and bookkeeping. Knowing what they refer to as well as how to forecast them is therefore important for small and large businesses alike. The Basics of Computer Software Depreciation – Common Q’s Answered Some parts of GAAP accounting rules can be more tricky, and software and how it is depreciated can be one of those. And with that, we will wrap up our discussion on depreciation and amortization. It is a bit more complicated than that, it’s an article for a future day, but the concept remains simple.

Good Deal did not spend any cash in June, however, the entry in the Depreciation Expense account resulted in a net loss on the income statement. On the SCF, we convert the bottom line of the income statement for the month of June (a loss of $20) to the net amount of cash provided or used by operating activities, which was $0.

The average remaining useful life of a company’s assets can be estimated as net PPE divided by depreciation expense, although the accounting useful life may not necessarily correspond to the economic useful life. An income statement summarizes a business’s profitability and financial results for a period.

How does depreciation and amortization affect financial statements?

Amortization and depreciation are non-cash expenses on a company's income statement. Depreciation represents the cost of capital assets on the balance sheet being used over time, and amortization is the similar cost of using intangible assets like goodwill over time.

The useful life of the patent for accounting purposes is deemed to be 5 years. So, the asset is amortized at 20% per year or 6,000 dollars per year. The accumulated amortization is the total value of the asset amortized since it was How To Use Depreciation And Amortization For Your Financial Reports acquired. The cost of the long-term, tangible assets can be deducted as business expenditures , which in turn reduces the taxable income. Then the annual or monthly depreciation amount is determined using depreciation methods.

Companies may also recognize this type of intangible asset when they acquire groups of customer accounts in an asset acquisition. Such assets are often measured using an income approach, which uses valuation techniques to convert future amounts (e.g., cash flows or earnings) to a single present value amount . This approach may also provide evidence as to the assets’ useful lives and the pattern of economic benefit expected to be derived. Keep in mind that both amortization and depreciation occur on both the income statement and balance sheet each year, and they are considered non-cash expenses in accounting terms. For example, in our example above, the company doesn’t write a check each year for $2,143. Instead, depreciation and amortization represent the reduction in the economic cost of the asset over time. A business records the cost of an intangible asset in the assets section of its balance sheet only when it purchases it from another party and the asset has a finite life.

- As we touched on previously, the underlying goal of financial reporting is to provide insight into certain aspects of a business.

- Based on this information, write footnotes to accompany the statements.

- For this example, this ending cash balance represents the real cash balance at the end of the company’s fiscal year.

- Then the annual or monthly depreciation amount is determined using depreciation methods.

- The cost model is identical to the cost model used for property, plant, and equipment, but the fair value model differs from the revaluation model used for property, plant, and equipment.

Comments