Content

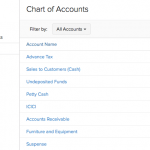

It is then added to their total AR to get the approximate dues they expect will be cleared by their customers. Businesses that offer trade credit to their customers keep an allowance for doubtful accounts on their balance sheet. It is an estimate of the amount of accounts receivable that a business expects to become bad debt. Contra assets are still recorded along with other assets, though their natural balance is opposite of assets. While assets have natural debit balances and increase with a debit, contra assets have natural credit balance and increase with a credit. This amount is reflected as a contra-asset on the statement of net assets.

If a customer ends up paying (e.g., a collection agency collects their payment) and you have already written off the money they owed, you need to reverse the account. For many business owners, it can be difficult to estimate your bad debt reserve.

AR aging method

The longer the time passes with a receivable unpaid, the lower the probability that it will get collected. An account that is 90 days overdue is more likely to be unpaid than an account that is 30 days past due. It is important to consider other issues in the treatment of bad debts. This variance in treatment addresses taxpayers’ potential to manipulate when a bad debt is recognised.

CASELLA WASTE SYSTEMS INC MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K) – Marketscreener.com

CASELLA WASTE SYSTEMS INC MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K).

Posted: Fri, 17 Feb 2023 21:58:08 GMT [source]

By predicting the amount of accounts receivables customers won’t pay, you can anticipate your losses from bad debts. Explore how businesses use the allowance method for bad debt and how to calculate bad debt expenses. The company can recover the account by reversing the entry above to reinstate the accounts receivable balance and the corresponding allowance for doubtful account balance.

Pareto Analysis Method

The allowance for doubtful accounts is also known as the allowance for bad debt and bad debt allowance. Note that the accounts receivable (A/R) account is NOT credited, but rather the allowance account for doubtful accounts, which indirectly reduces A/R. In effect, the allowance for doubtful accounts leads to the A/R balance recorded on the balance sheet to reflect a value closer to reality. The allowance for doubtful accounts is then used to approximate the percentage of “uncollectible” accounts receivable (A/R). Later, a customer who purchased goods totaling $10,000 on June 25 informed the company on August 3 that it already filed for bankruptcy and would not be able to pay the amount owed. The company would then write off the customer’s account balance of $10,000.

If your customers have requested extended payment terms, it could cause an increase in older receivables on your company’s aging schedule. In this situation, if your company’s allowance is based on aging, you may need to consider adjusting your assumptions based on current conditions. So far, we have used one uncollectibility rate for all accounts receivable, regardless of their age. However, some companies use a different percentage for each age category of accounts receivable. When accountants decide to use a different rate for each age category of receivables, they prepare an aging schedule. An aging schedule classifies accounts receivable according to how long they have been outstanding and uses a different uncollectibility percentage rate for each age category.

Why Track Allowance for Doubtful Accounts?

Because there is an inherent risk that clients might default on payment, accounts receivable have to be recorded at net realizable value. The portion of the account receivable that is estimated to not be collectible is set aside in a contra-asset account, called Allowance for Doubtful Accounts. At the end of each accounting cycle, adjusting entries are made to charge uncollectible receivable as expense. The amount of uncollectible receivable is written off as an expense from Allowance for Doubtful Accounts. In the case of the Allowance for bad debts, it is a contra account that is used to reduce the Controlling account, Accounts Receivable. At the end of an accounting period, the Allowance for bad debts reduces the Accounts Receivable to produce Net Accounts Receivable. Note that allowance for bad debts reduces the overall accounts receivable account, not a specific accounts receivable assigned to a customer.

- In a few rare cases, you might have a customer pay his debt after you’ve given up on it and written it off.

- Under the percentage-of-sales method, the company ignores any existing balance in the allowance when calculating the amount of the year-end adjustment .

- The first entry reverses the bad debt write-off by increasing Accounts Receivable and decreasing Bad Debt Expense for the amount recovered.

- For example, if a business has a total accounts receivable of $1,000,000 and their allowance for doubtful accounts is 5%, which is $50,000, then the net AR will be $950,000.

Because it is an estimation, it means the exact account that is uncollectible is not yet known. Under the accrual method of accounting, your company will report accounts receivable on its balance sheet if it extends credit to customers. This asset represents invoices that have been sent to customers but are yet unpaid. Receivables are classified under current assets if a company expects to collect them within a year or the operating cycle, whichever is longer.

What is the Allowance for Doubtful Accounts?

In such cases, the business must first debit its AR account and credit its allowance for doubtful accounts. The Pareto analysis method analyzes only large accounts that total up to 80% of the overall receivables. Businesses can then identify the most important and high-risk accounts and get an approximate idea of which customers might default. For the smaller accounts, the business then uses the historical percentage method. The Pareto analysis method is generally used by companies that have only a few large accounts. Suppose a company generated $1 million of credit sales in Year 1 but projects that 5% of those sales are very likely to be uncollectible based on historical experience. The most prevalent approach — called the “percent of sales method” — uses a pre-determined percentage of total sales assumption to forecast the uncollectible credit sales.

- For companies having minimal bad debt activity, a quarterly update may be sufficient.

- This method works best if there are a small number of large account balances.

- The third method takes the most granular approach yet by assigning personalized default risk percentages to each customer based on historical trends.

Sponsors generally require an Allowance for Uncollectible Accounts before paying the University for the award. For all sponsored projects, invoices are produced from the billing system. Once an invoice is produced, a Grants Receivable is recorded and an aging process begins based on the date of the invoice.

The allowance method follows GAAP matching principle since we estimate uncollectible accounts at the end of the year. We use this estimate to record Bad Debt Expense and to setup a reserve account called Allowance for Doubtful Accounts based on previous experience with past due accounts. We can calculate this estimates based on Sales for the year or based on Accounts Receivable balance at the time of the estimate . The percentage of receivables approach is another simple approach for calculating bad debt, but it too does not consider how long a debt has been outstanding and the role that plays in debt recovery.

Where are uncollectible accounts recorded?

Both bad debt expense and the allowance for doubtful accounts are reported on the balance sheet. Bad debt expense is reported on the income statement; the allowance for doubtful accounts is reported on the balance sheet.

With this https://personal-accounting.org/, accounts receivable is organised into categories by length of time outstanding, and an uncollectible percentage is assigned to each category. The length of uncollectible time increases the percentage assigned. For example, a category might consist of accounts receivable that is 1–30 days past due and is assigned an uncollectible percentage of 3%.

Comments